In every business, money constantly flows in and out — but managing that flow effectively is what keeps organizations running smoothly. Two essential components of this financial cycle are Accounts Payable (AP) and Accounts Receivable (AR).

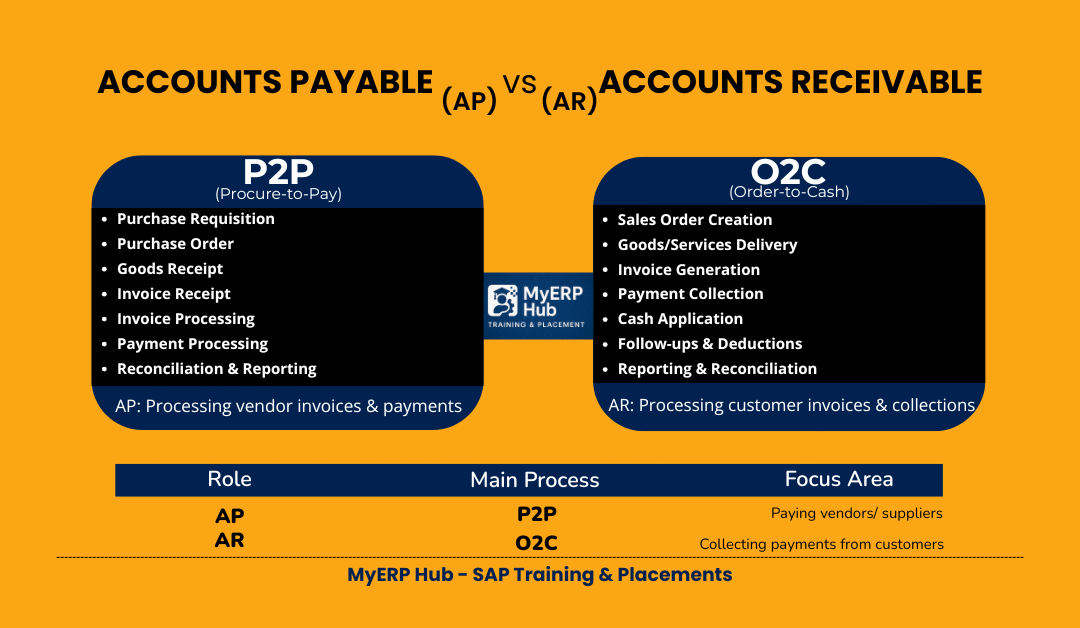

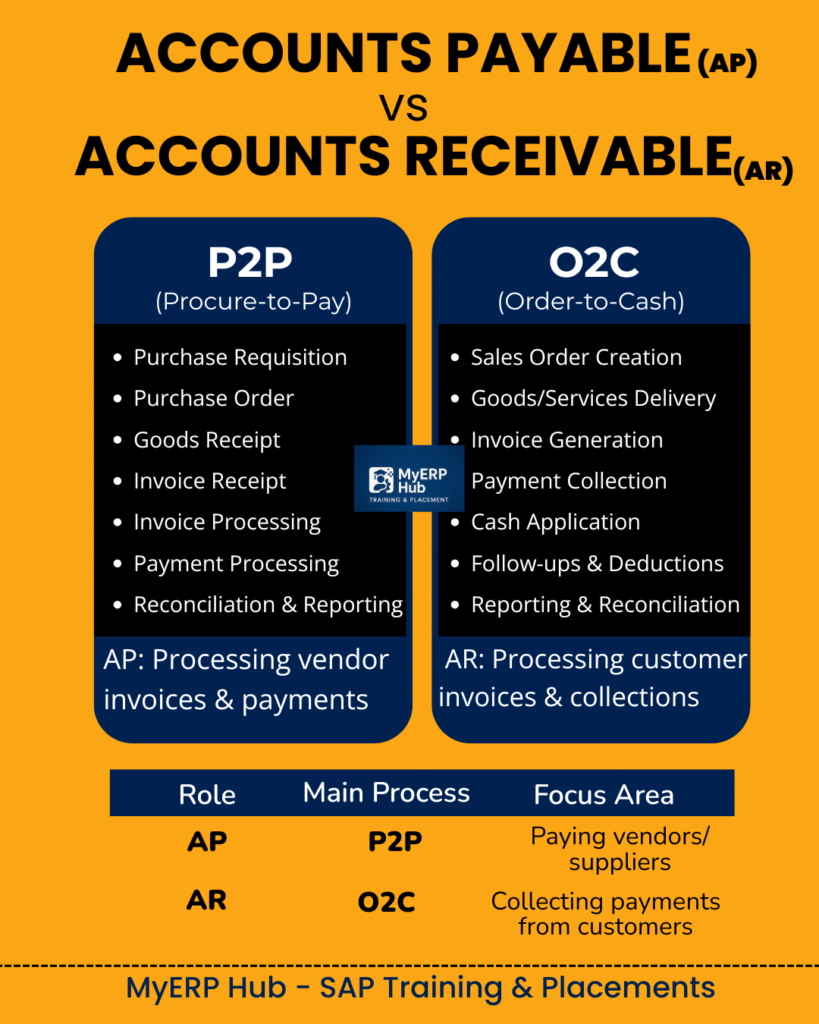

For SAP FICO learners, understanding these two processes is critical. They form the foundation of the Procure-to-Pay (P2P) and Order-to-Cash (O2C) cycles that drive every company’s financial operations.

💡 What Is Accounts Payable (AP)?

Accounts Payable (AP) represents the money a company owes to its suppliers or vendors for goods and services received. In simple terms, it’s the process of managing outgoing payments and ensuring vendors are paid correctly and on time.

AP is a vital part of the Procure-to-Pay (P2P) cycle, which includes:

- Purchase Requisition

- Purchase Order

- Goods Receipt

- Invoice Receipt

- Invoice Processing

- Vendor Payment

- Reconciliation & Reporting

📘 Example:

When a company buys office supplies on credit, the amount owed to the supplier is recorded as Accounts Payable until payment is made.

In SAP FICO, AP integrates with the FI module to manage vendor accounts, automate invoice postings, and track payment terms efficiently.

💰 What Is Accounts Receivable (AR)?

Accounts Receivable (AR) represents the money a company expects to receive from customers for goods or services sold on credit. In other words, AR manages incoming payments from customers.

It’s part of the Order-to-Cash (O2C) cycle, which includes:

- Sales Order Creation

- Goods/Services Delivery

- Invoice Generation

- Payment Collection

- Cash Application

- Follow-Ups & Deductions

- Reporting & Reconciliation

📘 Example:

When a company sells a product to a client on credit, that amount becomes Accounts Receivable until the payment is collected.

In SAP FICO, AR helps automate customer billing, monitor outstanding invoices, and generate real-time collection reports.

⚖️ Key Differences Between AP and AR

| Feature | Accounts Payable (AP) | Accounts Receivable (AR) |

|---|---|---|

| Main Process | Procure-to-Pay (P2P) | Order-to-Cash (O2C) |

| Focus Area | Paying Vendors / Suppliers | Collecting Payments from Customers |

| Nature of Process | Expense Process | Income Process |

| Accounting Entry | Liability | Asset |

| Involved Module in SAP | FI Module (Vendor Accounts) | FI Module (Customer Accounts) |

Understanding both ensures better cash-flow management and smoother reconciliation between vendor and customer ledgers.

🎓 Importance of AP & AR in SAP FICO

For finance professionals and SAP aspirants, mastering AP and AR processes is essential. These are the building blocks of real-time financial operations.

👉 AP ensures accurate vendor payments and cash-outflow control.

👉 AR helps maintain healthy cash inflow and timely customer collections.

In SAP FICO, these modules integrate seamlessly, helping organizations maintain accuracy in balance sheets, general ledgers, and financial reporting.

Professionals who understand both AP and AR can easily transition into roles such as SAP FICO Consultant, Accounts Executive, Finance Analyst, or SAP Support Specialist.

🚀 Learn AP & AR Practically at MyERP Hub

At MyERP Hub, we don’t just teach theory — we focus on hands-on learning using real-time SAP FICO scenarios.

Our expert-led training covers:

✅ Complete SAP FICO configuration and customization

✅ Real-world AP & AR workflows (P2P and O2C)

✅ End-to-End project implementation guidance

✅ 100% placement support after course completion

📍 Available Modes: Online & Offline

📞 WhatsApp Now to Join Our Next Batch

Grow your career with MyERP Hub – India’s trusted SAP Training & Placement Institute!